Chart :

Reflections:

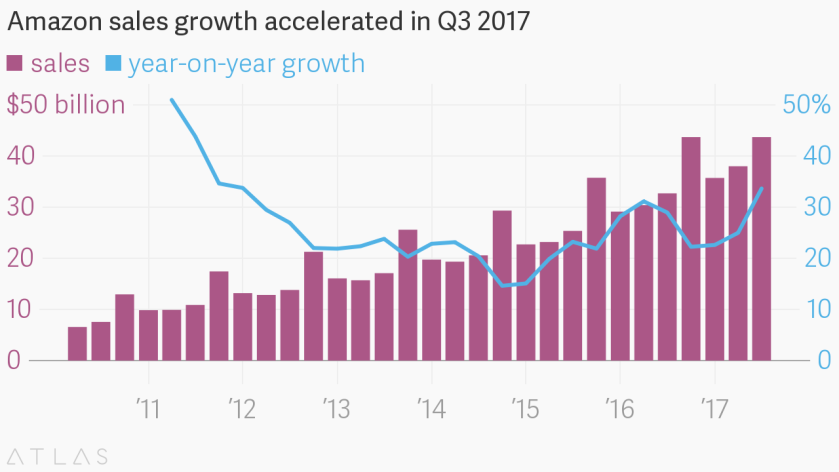

This week has mostly been about Tech companies, most of which have delivered solid topline and bottomline growth this quarter. Among the companies on everyone’s lips is Amazon. Scott Galloway, author of The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google, tells us that 58% of Americans have amazon prime accounts (that is 2% more than voted in the 2016 US elections) while adventures.es indicate that 52 % of American consumers start their online buying process at Amazon. Bottom line is Amazon is a thousand pound gorilla. Evidently, whenever rumour spreads of Amazon is entering a market,

the rumour alone is enough to practically send shivers down the stocks prices of competitors especial retail stocks as can be seen here. Asked for advice to start ups, Jeff Bezos, Amazon founder and CEO, responded: “value your customers, hire well, find a market that isn’t being served, and realize that someday I will utterly crush you.”

It was also the week I came across Jeff Bezos ‘ value minimization framework:

The framework I found, which made the decision incredibly easy, was what I called — which only a nerd would call — a “regret minimization framework.” So I wanted to project myself forward to age 80 and say, “Okay, now I’m looking back on my life. I want to have minimized the number of regrets I have.” I knew that when I was 80, I was not going to regret having tried this. I was not going to regret trying to participate in this thing called the Internet that I thought was going to be a really big deal. I knew that if I failed I wouldn’t regret that, but I knew the one thing I might regret is not ever having tried. I knew that that would haunt me every day, and so, when I thought about it that way it was an incredibly easy decision.

Articles:

This article is one of the outstanding pieces I have read this week. He first draws some deep lessons from the well of Warren Buffet and his investment approach. Then, he emphasizes the need for long-term perspective before developing a retrospective analysis of three companies in 3 different continents which turned out to multibaggers (companies whose returns to investors are more than tenfold). The companies are the REA Group (Australia, online real estate advertising), Philippine Seven (Philippines, Retail) and AutoZone (USA, Autoparts retailer). The analysis is deep, detailed and lesson-filled.

Morgan Housel uses examples from Newtonian physics and Quantum Theory to draw solid examples on how investing can both be knowable and unknowable and the lesson that a bit of both certainty and uncertainty in guiding principles is needed. Some things in investing are certain and some are not and blessed is the person who knows the difference and applies it to investing: “A company’s performance can be measured precisely…Like Newtonian physics. Market expectations aren’t like that. …They resist all attempts to figure them out in ways that make sense. They change constantly, without warning or reason. They can be different for two companies that look identical from the outside. At best, you can measure them with probabilities. Like quantum physics. Not distinguishing between the two in investing is dangerous.”

- First, purpose is built not just found. “most of us have to focus as much on making our work meaningful as in taking meaning from it. Put differently, purpose is a thing you build, not a thing you find….purpose is often primarily derived from focusing on what’s so meaningful and purposeful about the job and on doing it in such a way that that meaning is enhanced and takes center stage.”

- Secondly, one can have multiple purposes not just a single purpose so perhaps quit looking for that one thing you can do as a purpose. “Acknowledging these multiple sources of purpose takes the pressure off of finding a single thing to give our lives meaning.”

- Third, purpose is not static and can change over time. In nerdy terms, purpose can be defined as a function of time.

Mike Erwin, the co-author of Lead Yourself First: Inspiring Leadership Through Solitude , cites research that shows IQ drops by 5 -15 points while performance drop by up to 50% when multitasking. He makes the case for solitude in a distracted world. His suggestions include starving distractions, creating a stop doing list and building periods of solitude into the schedule. Reminds me of Sheldon cooper who used to take his solitude time every day at the same time until his friends became curious on what he did during his spare time.

Warren buffett is a legend in the investment world with his consistent earnings record using the time tested concentrated value investing. His investment horizon is long and his bets are big. What´s happening now is that private equity titans are taking an interest in his investment approach: “So a few of the biggest names in the industry, Carlyle Group, Blackstone Group, and KKR, set about building their long-duration private equity businesses, hiring teams and raising multibillion-dollar funds (or forming long-life partnerships) to buy companies that are projected to perform well over a longer time frame than the short hold period of a standard buyout fund.”